A Guide To Navigating India’s Dynamic GST Rates

The comprehensive indirect tax known as the Goods and Services Tax (GST) has completely changed the way that taxes are collected in India. It has taken the place of numerous indirect taxes, resulting in a more unified and open tax system. The rate structure of the GST, which establishes the tax obligations for different commodities and services, is one of its fundamental features. The GST rate structure in India as of 2023, including the several types of GST rates and their effects, will be covered in detail in this article.

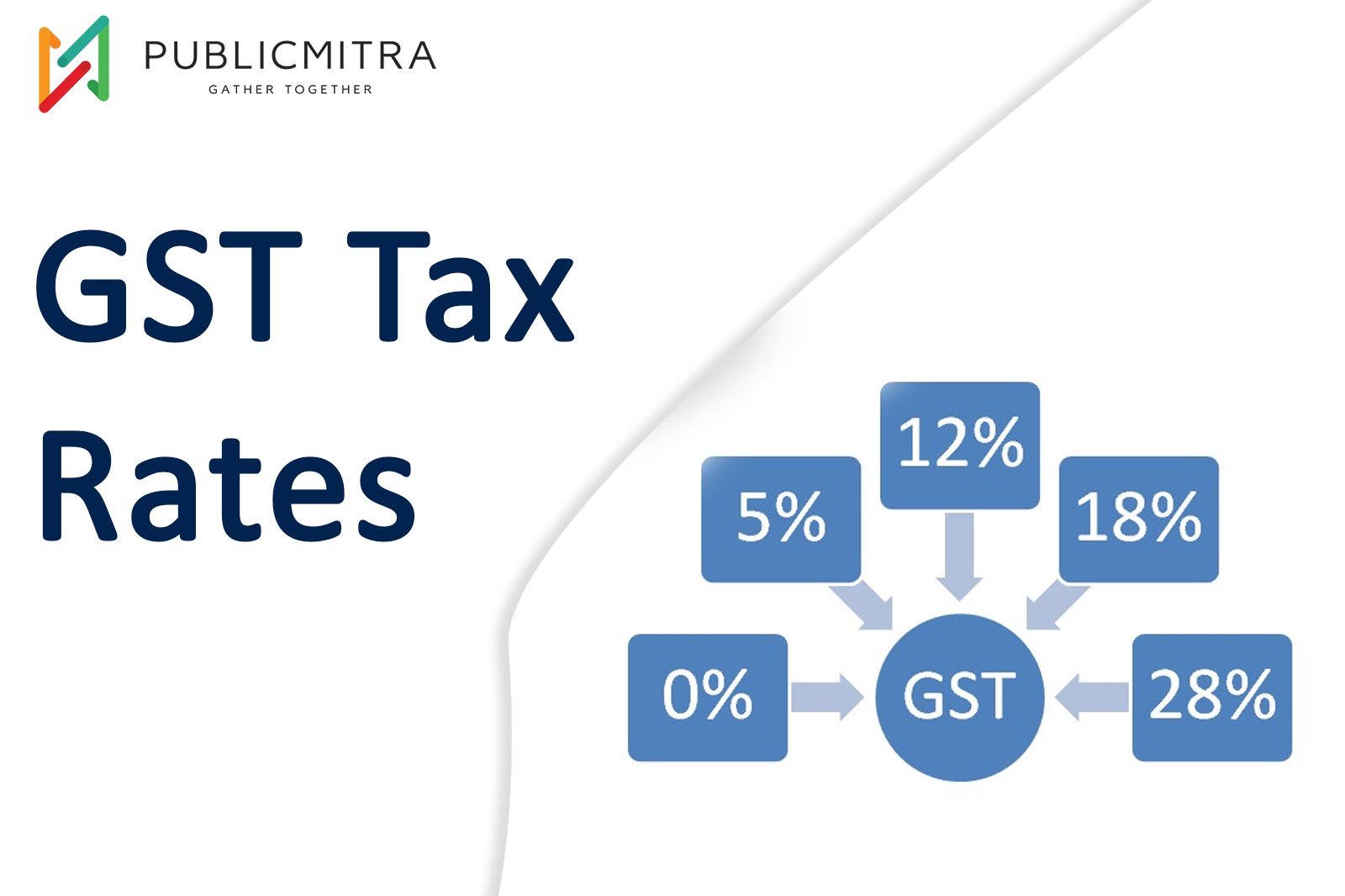

GST Rates Overview

The CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), and IGST (Integrated Goods and Services Tax) Acts apply various percentage rates of tax on the sale of goods and services. Every company that has registered with the GST must generate invoices that include the GST amounts charged on the value of the supply.

For intra-state transactions, both the CGST and SGST GST rates are often the same. In contrast, the GST rate for IGST, which is applicable to transactions between states, is almost equal to the sum of the CGST and SGST rates.

Types of GST Rates and GST Rate Structure in India

Primary GST Slabs

- For regular taxpayers in India, the following are the main GST slabs:

- Nil-Rated (0%): Products and services in this category are exempt from GST. Healthcare services and some basic goods including rice, wheat, flour, and curd are excluded from the GST.

- 5%: A reasonable 5% tax is levied on a few items and services. This covers things like fundamental services and supplies for the home.

- 12%: The GST rate for items and services falling under this category is 12%. It includes things like processed foods and a few services.

- 18%: The bulk of products and services fall within this category and are subject to an 18% GST rate. This covers things like electronics, dining services, and other things.

- 28%: The highest GST slab is 28%, applicable to luxury goods, automobiles, and services like hotels with room tariffs exceeding a specified limit.

Lesser-Used GST Rates

There are additional, less popular GST rates in addition to the main slabs, including:

3%: Specific items like gold and jewelry are subject to a lower rate of 3%.

0.25%: Some products, such as uncut precious and semi-precious stones, have a very low GST rate.

Composition Taxable Persons

Based on their revenue, and composition taxable individuals might choose to pay GST at reduced or nominal rates. Typically, these rates include

1.5%: Composition taxpayers are subject to a reduced GST rate of 1.5% on their annual revenue.

5%: Some composition-taxable individuals have the option of electing to pay 5% GST on their revenue.

6%: Composition taxpayers also have the option of paying GST at a rate of 6% on their revenue.

TDS and TCS under GST

Apart from the standard GST rates, there are provisions for Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) under GST:

TDS (Tax Deducted at Source): The TDS rate under GST is 2%. This means that individuals or entities making specified payments need to deduct 2% of the payment as TDS and remit it to the government.

TCS (Tax Collected at Source): The TCS rate under GST is 1%. Businesses that receive payments above a certain threshold for goods or services are required to collect 1% as TCS and deposit it with the government.

HSN and SAC Codes

All goods and services transacted in India are classified under the HSN (Harmonized System Nomenclature) code system or the SAC (Services Accounting Code) system under GST.

HSN System: The HSN code is an internationally accepted commodity description and coding system used by more than 200 countries. Over 98% of international trade merchandise is classified using the HSN code. In India, the HSN code is used for classifying goods for GST purposes. Goods are categorized into five GST slabs based on the HSN code: NIL, 5%, 12%, 18%, and 28%.

SAC System: The SAC code, on the other hand, is a classification system developed for services by the Service Tax Department of India. The GST rates for services are fixed in five slabs using the SAC code: 0%, 5%, 12%, 18%, and 28%. If a service is not exempt from GST or specific rates are not provided, the default GST rate for services is 18%.

Understanding these codes is essential for businesses to correctly classify their products and services and apply the appropriate GST rates.

The GST rate structure in India is diverse, catering to various goods and services. It is crucial for businesses and consumers to be aware of these rates as they have a significant impact on the cost of goods and services. Additionally, the HSN and SAC codes play a vital role in determining the applicable GST rates, making it essential for businesses to correctly classify their products and services under these codes to ensure compliance with GST regulations. Stay informed about the latest updates on GST rates to navigate the dynamic tax landscape effectively.