A Comprehensive Guide Of The Types Of GST

Have you finally grasped the idea of GST? Let’s dig deeper. Goods and Services Tax, commonly known as GST, has revolutionized the taxation system in India. One crucial aspect of GST is the GSTIN, or Goods and Services Tax Identification Number, which is essential for businesses to operate under this new tax regime. In this article, we will delve into the various aspects of GSTIN, including its format, registration process, verification, and the benefits it offers.

GSTIN: The Cornerstone of GST

GSTIN, or Goods and Services Tax Identification Number, is a unique 15-digit identification number assigned to every taxpayer registered under the GST regime. It replaces the earlier Tax Identification Number (TIN) issued under the state VAT law. Obtaining a GSTIN is free of cost and is a fundamental requirement for conducting business under GST.

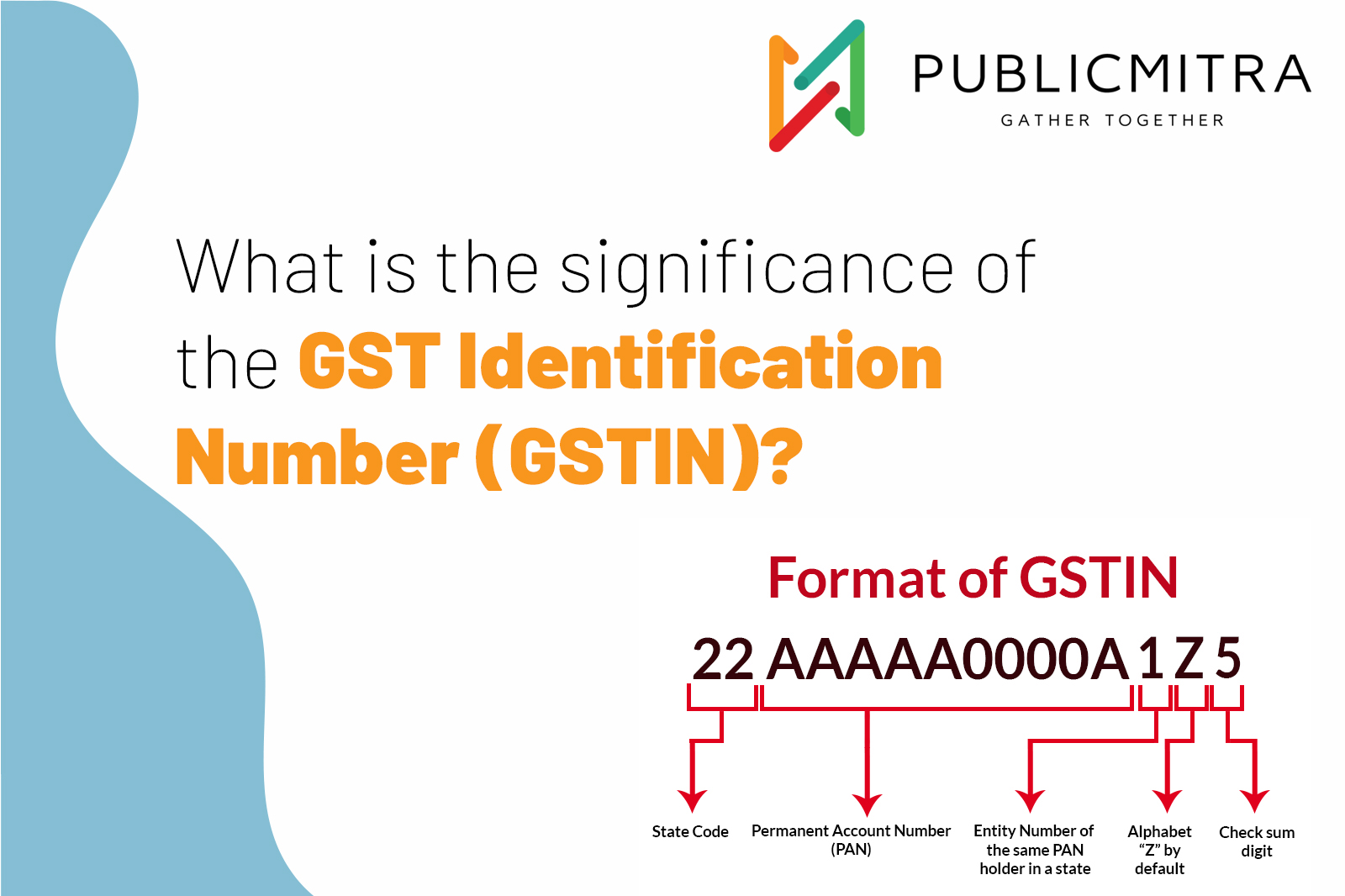

Breaking Down the GSTIN Format

Understanding the structure of a GSTIN is crucial. Here’s a breakdown of its format:

GSTIN Full Form: Goods and Services Tax Identification Number

First 2 Digits: Represent the state code

Next 10 Digits: Correspond to the PAN (Permanent Account Number) of the taxpayer

Thirteenth Digit: Based on the number of registrations within a state under the same PAN

Fourteenth Digit: Defaulted as “Z”

Last Digit: Check code for error detection, can be a number or an alphabet

For instance, if a business has only one registration in a state, the thirteenth digit of its GSTIN will be “1.” If it obtains a second registration in the same state, the thirteenth digit becomes “2.” This system allows businesses to have up to 35 business verticals registered within a state.

Obtaining a GSTIN: The Registration Process

Registering for a GSTIN is a crucial step for businesses. It can be done through two methods:

Through the GST Portal

1. Visit the GST online portal at [https://services.gst.gov.in/services/quicklinks/registration](https://services.gst.gov.in/services/qubacklinks/registration).

2. Fill in your name, email ID, and mobile number in Part A of the application.

3. Verify your details using the OTP sent to your registered mobile and email.

4. After verification, you will receive an Application Reference Number (ARN) via mobile or email.

5. Complete Part B of the application, providing required documents like photographs, business location proof, bank account details, and an authorization form.

6. Apply using either a Digital Signature Certificate (DSC) or Aadhaar OTP.

7. The GST officer will verify your application within 3 working days. They may either approve it, leading to the issuance of a Certificate of Registration (Form GST REG 06), or request additional information using Form GST-REG-03.

8. If additional details are requested, provide them within 7 working days. The officer can either approve or reject the application, with reasons stated in Form GST-REG-05.

Through GST Seva Kendra

The second method is to visit a GST Seva Kendra in person. These centers are established by the government to assist taxpayers who may not have access to online services or need guidance on the GST process.

Verifying GSTIN: Ensuring Authenticity

To prevent fraudulent activities, it’s essential to verify the authenticity of a GSTIN. Here’s how you can do it:

1. Go to the GST Portal at [https://www.gst.gov.in/](https://www.gst.gov.in/).

2. Select “Search Taxpayer” from the menu.

3. Enter the GSTIN you wish to verify along with the provided captcha code.

4. If the GSTIN is valid, you will receive the following details:

– GSTIN Status

– Registration Date

– Type of Business Structure (Company, Sole Proprietorship)

– Type of Taxpayer (Regular, Composition, SEZ unit)

Benefits of Having a GSTIN

Obtaining a GSTIN offers several advantages to businesses:

1. Legal Recognition: It establishes a business as a legitimate supplier of goods or services, attracting more customers and fostering growth.

2. Input Tax Credit: Registered businesses can claim input tax credit on their purchases and input services, enhancing cost efficiency.

3. Interstate Sales: There are no restrictions on interstate sales for registered businesses, expanding their market reach.

4. E-commerce Presence: GST registration enables businesses to register on e-commerce platforms or open their own online stores, increasing their market scope.

5. Compliance and Rating: GST compliance, with most returns automated, results in a good GST rating, boosting business credibility.

GSTIN vs. GSTN: Clarifying the Difference

It’s important to note the distinction between GSTIN and GSTN. GSTIN refers to the Goods and Services Tax Identification Number, which is assigned to individual taxpayers. In contrast, the Goods and Services Tax Network (GSTN) is an organization responsible for managing the entire IT system of the GST portal. GSTN plays a vital role in tracking financial activities, providing services, and maintaining tax records for taxpayers.

The Importance of GSTIN

GSTIN is crucial for businesses to include on invoices, ensuring they receive the correct amount of input tax credit. Collecting customers’ GSTINs is equally important, as they are necessary for customers to claim input tax credits. Overall, obtaining a GSTIN is a necessary step for any company, as it helps maintain market credibility and facilitates the claiming of rightful input tax credits.

Who Should Register for GST?

Under the GST regime, businesses with turnovers exceeding the threshold limit (INR 40 lakh, INR 20 lakh, or INR 10 lakh, depending on the area of operation) must register as normal taxable persons. This registration is essential to comply with GST regulations and benefit from its advantages.

GST Seva Kendra: A Convenient Option

For those who need assistance with GST registration, GST Seva Kendras provides a convenient and accessible option. These service centers aim to simplify GST-related processes for taxpayers who may face challenges with online registration.

Benefits of GST for MSMEs

Micro, Small, and Medium Enterprises (MSMEs) can particularly benefit from GST in various ways:

Access to Government Schemes: Registered MSMEs can avail of government schemes and incentives designed to promote small business growth, such as refunds for GST paid by exporters.

Increased Credibility: GST registration requires meticulous record-keeping and timely tax payments, helping MSMEs establish financial discipline and credibility.

Reduced Tax Liability: Claiming Input Tax Credit can reduce tax liability, improving profitability and attractiveness to lenders and investors.

Market Competitiveness: GST compliance enhances an MSME’s reputation, making it more competitive in securing contracts from larger corporations and government agencies.

In conclusion, understanding the different types of GST and the significance of GSTIN is essential for businesses and individuals navigating the Indian taxation landscape. By obtaining a GSTIN and complying with GST regulations, businesses can unlock various benefits and contribute to the growth of the Indian economy.