A Multidimensional Approach To GST Compliance

The implementation of the Goods and Services Tax (GST) has a significant influence on the global taxation system, particularly in India, Canada, and Australia. The dense network of governmental laws and regulations controlling the careful collection, proper filing, and prompt payment of GST is governed by this multilayered framework, which serves as a cornerstone for enterprises.

In the following sections of this thorough article, we will dive deep into the complex world of GST compliance, breaking it down into its parts, illuminating its profound significance, and outlining practical tactics that businesses can use to strengthen their commitment to regulatory adherence.

What is GST?

At every stage of production or distribution, commodities and services are subject to the value-added tax known as GST. GST streamlines the taxation process by combining many taxes into a single tax, in contrast to traditional tax systems where multiple taxes are levied at various levels. This guarantees transparency, lowers tax avoidance, and stimulates the economy.

Types of GST Compliance

Registration Compliance:

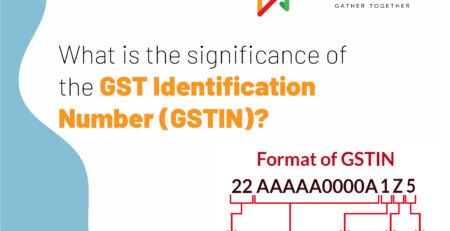

As required by the tax authorities, registration compliance includes the procedure of obtaining a GST registration number (GSTIN). Businesses must register for GST if their annual sales exceed specified levels.

This procedure entails submitting paperwork and information, including firm structure, annual revenue, and the type of goods or services offered. By registering, a firm assures that the government can keep tabs on its taxable activities.

Return Filing Compliance:

Compliance with return filing requirements is essential to GST. Depending on their revenue and the laws of their country, registered firms must submit GST reports regularly, usually monthly or quarterly.

All outgoing and incoming supplies, GST collected and paid, and admissible Input Tax Credits (ITC) are fully described in the GST return. To avoid fines and preserve good status with the tax authorities, timely and precise filing is crucial.

Payment Compliance:

Payment compliance entails sending GST obligations to the government on schedule. A business must pay the appropriate amount by the specified due dates after calculating its GST liability through the submission of a return.

To ensure that the government collects its fair share of taxes, payment compliance is essential. Failure to do so may result in penalties and interest charges.

Record-Keeping Compliance:

Keeping thorough and accurate records of GST transactions is necessary for record-keeping compliance. Invoices, receipts, purchase records, and other financial records that are necessary for GST compliance must be categorized and stored by businesses.

These documents, which form the basis for submitting GST returns, may be examined during tax audits. In addition to guaranteeing compliance, keeping organized and current records makes the process of data reconciliation for GST reporting easier.

Compliance with GST Invoice Rules:

Compliance with GST invoice standards entails following the detailed requirements for invoices set forth by the tax authorities. Many nations with GST systems require that invoices include particular facts, such as the GSTINs of the supplier and recipient, a distinct invoice number, information on the products or services provided, and GST rates.

Issues with compliance and disagreements may result from improperly issuing GST-compliant invoices.

Compliance with E-Way Bills (where applicable):

In some jurisdictions, the creation of electronic waybills, often known as e-way bills, is necessary for the transportation of products that exceed a specific value level. E-way bills are used in interstate transportation to keep track of the flow of goods and guarantee tax compliance. Businesses involved in such transactions are required to adhere to the e-way bill specifications.

How Important GST Compliance Is

Legal Requirement: GST compliance is mandated by law. Businesses are required to abide by the GST rules and restrictions imposed by the government. Penalties, fines, or even legal action may be imposed for failure to comply.

Tax System Transparency: GST compliance encourages tax system transparency. By ensuring precise tax collection and payment, it limits the opportunity for tax evasion and corruption.

Avoiding Penalties: Violations of the GST regulations may incur significant fines and interest costs. Businesses must adhere to the GST regulations to prevent financial damages.

Business Reputation: Ensuring GST compliance improves a company’s standing. A compliance company is more trustworthy and engaging, which can result in more customers and partners as well as more sales.

Input Tax Credit: Compliance enables firms to claim input tax credits (ITCs), which allow them to offset the GST they spent on inputs with the GST they have earned on outputs to lower their tax obligations.

Data reconciliation: Regularly comparing GST data to the financial records of a business enables problems to be found and quickly fixed.

Compliance with E-Invoicing: E-invoicing is required for some businesses in some countries. For GST compliance, adherence to e-invoicing rules is essential.

GST Audit: To ensure the correctness of a company’s GST reports and records, tax authorities may conduct GST audits. It is crucial to be ready for such audits.

In final words

GST compliance represents the core of responsible citizenship in the economic environment and goes beyond simple regulatory requirements. Businesses that place a high priority on GST compliance not only protect themselves from legal issues, but also help to advance the larger objective of creating a fair, effective, and equitable taxing system that, in the end, benefits the entire economy.

Businesses must be alert, stay current on changing GST legislation, and, when necessary, seek professional advice to successfully negotiate the complexities of GST compliance to prosper in this tax environment. By doing this, individuals take an active role in influencing how taxes are used in the future, ensuring that everyone has a more promising economic future.