Types Of GST: Understanding The Different Types Of Goods And Services Tax

The introduction of the Goods and Services Tax (GST) in India marked a pivotal moment in the country’s tax landscape. This comprehensive tax reform, implemented on July 1st, 2017, sought to simplify and streamline the taxation of goods and services, replacing a multitude of previous indirect taxes. In this article, we will delve into the various types of GST and their components, shedding light on the intricacies of this transformative tax system.

Understanding GST: A Brief Overview

Before we delve into the different types of GST, it’s essential to understand the fundamental concept of GST. GST is a value-added tax applied to the supply of goods and services for domestic consumption. It is an all-encompassing, single indirect tax system designed to create a unified tax structure across the country. Under GST, the tax is included in the final price of a product, with consumers paying the total price, including GST. Subsequently, businesses or sellers remit their GST portion to the government.

Objectives of GST

The introduction of GST aimed to achieve several key objectives:

1. Elimination of Multiple Tax Systems: GST sought to replace a convoluted system of various indirect taxes, simplifying the taxation structure.

2. Increased Business Compliance: It aimed to encourage businesses to become more tax-compliant by streamlining tax processes.

3. Price Reduction: By eliminating cascading taxes, GST is intended to reduce the overall tax burden on consumers and businesses, potentially leading to lower prices for goods and services.

4. Revenue Boost: GST was expected to boost the country’s overall tax revenue, enabling the government to allocate resources more efficiently.

5. Enhanced Efficiency and Productivity: The unified tax system was designed to improve operational efficiency and productivity for businesses.

The Taxes Replaced by GST

Before we explore the different types of GST, it’s crucial to acknowledge the taxes that GST replaced. Some of the prominent taxes absorbed by GST include:

– VAT (Value Added Tax)

– Octroi

– Entertainment Tax

– Tax on Lottery

– Luxury Tax

– Purchase Tax

– Service Tax

– Additional Excise Duty

– Central Excise Duty

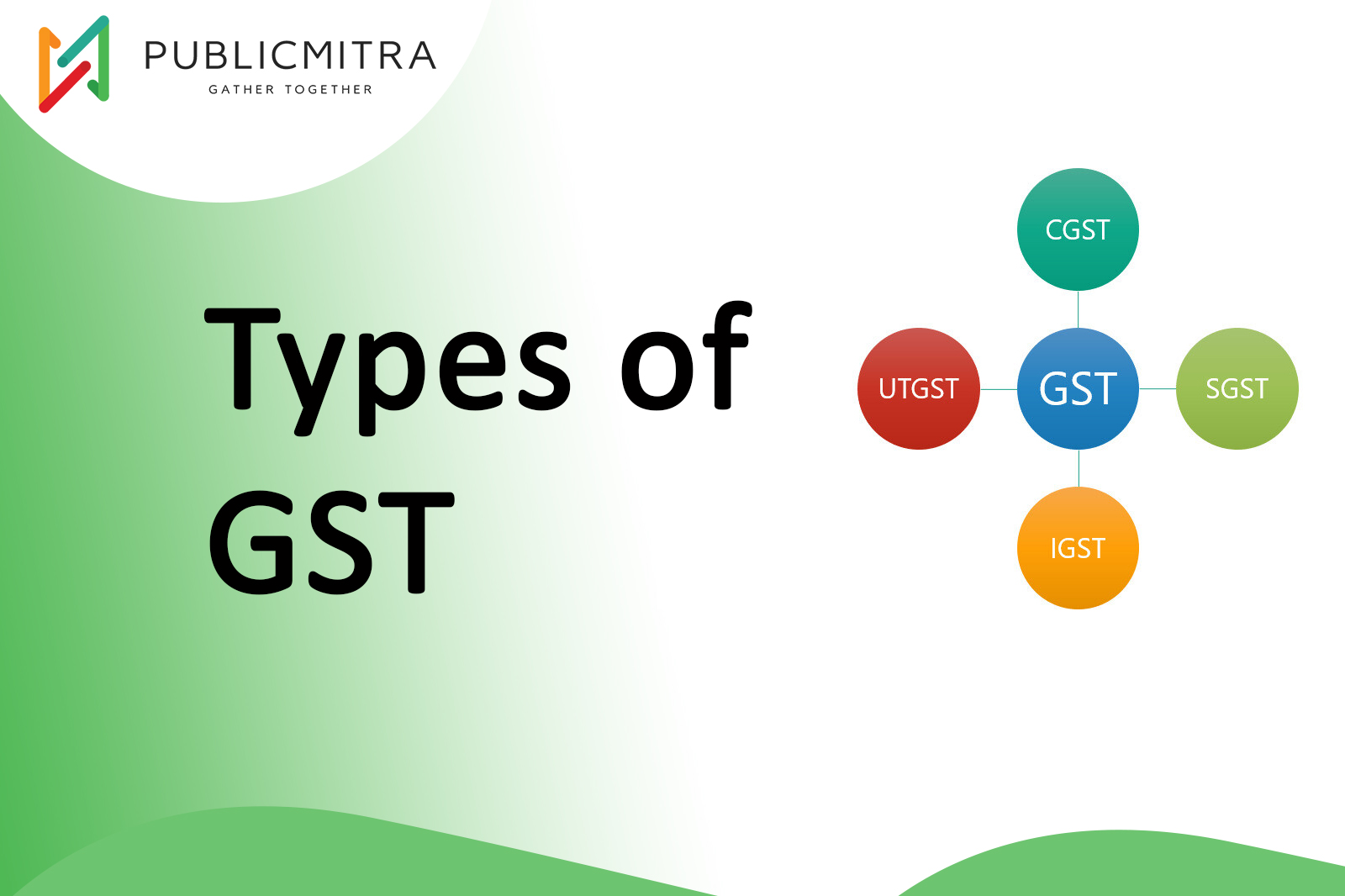

Different Types of GST Tax

The GST structure is built around the nature of transactions, classifying them into three primary types:

1. State Goods and Services Tax (SGST)

SGST is levied on intra-state transactions of goods and services, where both the supplier and the consumer are located within the same state. The revenue generated through SGST goes exclusively to the state government in which the transaction occurs. SGST replaces earlier state-level taxes like purchase tax, luxury tax, VAT, and Octroi. In Union Territories, a similar tax called Union Territory Goods and Services Tax (UGST) is applicable.

2. Central Goods and Services Tax (CGST)

CGST is applied to intra-state transactions of goods and services, much like SGST. However, the revenue collected through CGST is shared equally between the central and state governments. This ensures a balanced distribution of revenue for both levels of government.

3. Integrated Goods and Services Tax (IGST)

IGST comes into play when transactions involve the movement of goods or services between two states or are related to imports and exports. The revenue collected through IGST is shared between the state and central governments, ensuring seamless taxation on inter-state transactions.

Components of GST in Detail

SGST (State Goods and Services Tax)

SGST is imposed on intrastate transactions, where both the supplier and the consumer are within the same state. The state government levies SGST, and the revenue generated stays with the respective state. For instance, if a trader in West Bengal sells goods to a customer in West Bengal, the GST applied will comprise both CGST and SGST, each at 9% in case of an 18% GST rate.

CGST (Central Goods and Services Tax)

Similar to SGST, CGST applies to intrastate transactions but is collected by the Central Government. The revenue from CGST is then shared with the state government. In the same example mentioned earlier, 9% of the GST collected (in this case, Rs. 450) goes to the Central Government as CGST.

UTGST (Union Territory Goods and Services Tax)

UTGST mirrors SGST but is applicable in Union Territories such as Chandigarh, Puducherry, Andaman and Nicobar Islands, Daman and Diu, and Dadra and Nagar Haveli. The revenue generated from UTGST remains with the respective Union Territory government and is collected in addition to CGST.

IGST (Integrated Goods and Services Tax)

IGST applies to interstate transactions and imports/exports, ensuring a smooth and uniform tax structure for goods and services moving across state borders. The Central Government collects IGST, and the revenue is subsequently distributed among the concerned states. For example, when a trader in West Bengal sells goods to a customer in Karnataka, IGST is applicable, and the revenue collected goes to the Central Government, ensuring fair distribution.

In conclusion, the implementation of GST revolutionized India’s tax system by unifying various indirect taxes under a streamlined structure. Understanding the different types of GST and their components is crucial for businesses and consumers alike, as it helps ensure compliance and transparency in the tax regime while contributing to the country’s economic growth.