UAE vs India FD Tax Rates: A Deep Dive into Fixed Deposit Returns, Taxation, and Real Value in 2025

Introduction

Fixed deposits (FDs) remain a cornerstone of conservative investing, offering capital protection and guaranteed returns. However, the real value of FD returns can differ dramatically based on where you invest. In 2025, the contrast between UAE vs India FD tax rates and their impact on post-tax, inflation-adjusted, and currency-adjusted returns has become a hot topic among investors, especially Non-Resident Indians (NRIs) and global savers.

This article provides a comprehensive, data-driven comparison of FD returns in the UAE and India, covering:

- Interest rates and tax treatment

- Currency depreciation and inflation

- Real, post-tax returns in both countries

- Strategic considerations for NRIs

- Regulatory and economic context

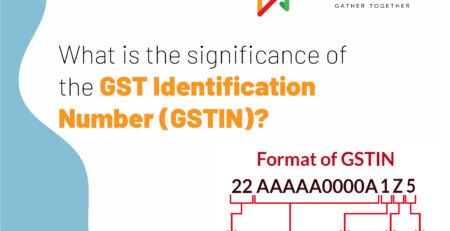

FD Interest Rates and Taxation: UAE vs India

UAE FD Rates and Taxation

- FD Interest Rate: Typically around 4.5% per annum in 2025.

- Taxation: No personal income tax on FD interest for individuals in the UAE.

- Currency Impact: The UAE dirham (AED) is pegged to the US dollar, and the Indian rupee (INR) has historically depreciated by 3–4% per year against USD/AED.

Key Point:

FD interest in the UAE is tax-free, and when adjusted for INR depreciation, can yield an effective return of around 8% in INR terms for Indian investors.

India FD Rates and Taxation

- FD Interest Rate: Around 7% per annum in 2025 for top banks.

- Taxation: Interest is taxed at the individual’s income tax slab rate—up to 30% for those in the highest bracket.

- Post-tax Return: For a 30% tax bracket, the post-tax FD return is about 4.9%.

- Inflation: The official inflation rate averages 5% per year over the past five years.

Key Point:

FD interest in India is fully taxable, and post-tax returns often struggle to beat inflation, especially for high-income individuals.

Comparative Table: UAE vs India FD Returns (2025)

| Parameter | UAE FD (AED) | India FD (INR) |

|---|---|---|

| Nominal FD Rate | 4.5% | 7% |

| Tax on Interest | 0% (Tax-Free) | Up to 30% |

| Post-Tax Return | 4.5% | 4.9% (at 30% tax) |

| Currency Depreciation | INR falls 3–4%/yr | N/A |

| Inflation (avg.) | ~3% (UAE CPI) | ~5% |

| Real Return (approx.) | 8% (INR terms) | 0% to -0.1% |

Note: Real return for UAE FDs in INR terms factors in currency depreciation; Indian real return factors in post-tax and inflation.

How Currency Depreciation Changes the Game

For Indian investors or NRIs comparing FD returns, currency depreciation is a critical factor. The Indian rupee has depreciated by 3–4% per year against the US dollar and AED. This means:

- UAE FD returns, when converted to INR, gain an extra 3–4% per annum due to currency movement.

- For NRIs, a 4.5% tax-free FD in UAE becomes 7.5–8.5% in INR terms after accounting for rupee depreciation.

Example Calculation:

- Invest AED 100,000 at 4.5% in UAE FD

- No tax; interest earned = AED 4,500

- If INR depreciates 4% against AED, your AED balance is worth 4% more in INR

- Effective INR return ≈ 8.5%

Inflation and Real Returns: The Hidden Erosion

India

- FD nominal rate: 7%

- Tax (30%): 2.1%

- Net return: 4.9%

- Inflation: 5%

- Real return: 0% or slightly negative (your FD barely keeps up with inflation, or loses value in real terms).

UAE

- FD nominal rate: 4.5% (tax-free)

- Currency gain (INR depreciation): 3–4%

- Effective INR return: 7.5–8.5%

- UAE inflation: ~3%

- Real return (INR terms): Significantly positive (your wealth grows in INR purchasing power).

Taxation Systems: A Closer Look

UAE Taxation

- No personal income tax on salary, interest, or capital gains for individuals.

- Corporate tax: Introduced at 9% (for profits over AED 375,000), but does not affect personal FD interest.

- No wealth tax, inheritance tax, or property tax on ownership (though there are transaction fees).

- Tax treaties: The India-UAE Double Tax Avoidance Agreement (DTAA) ensures NRIs are not taxed twice on the same income.

India Taxation

- Progressive personal income tax: 5% to 30%, plus surcharges and cess.

- FD interest is fully taxable as per slab.

- Tax-saving FDs: Offer deduction under Section 80C (up to ₹1.5 lakh), but interest remains taxable.

- Capital gains, property, and other taxes apply as per asset class.

NRI Perspective: Double Tax Avoidance and Wealth Planning

The India-UAE DTAA allows UAE-based NRIs to avoid double taxation on interest income. For example:

- Interest earned in India by UAE residents: Subject to a reduced withholding tax rate of 12.5% (instead of 30%) under the DTAA.

- Interest earned in UAE: Remains tax-free for individuals.

- Financial planning: NRIs can optimize returns by leveraging the DTAA and choosing the most tax-efficient jurisdiction for their savings.

Strategic Considerations: Where Should You Park Your FDs?

For Indian Residents

- FDs in India offer safety and liquidity, but post-tax, post-inflation returns are minimal or negative for those in higher tax brackets.

- Tax-saving FDs provide some relief under Section 80C, but interest is still taxed, and lock-in periods reduce flexibility.

For NRIs and UAE Residents

- FDs in the UAE are highly attractive due to tax-free interest and currency appreciation against INR.

- No personal income tax means you keep the full interest earned.

- Currency gains further boost real returns when converting AED savings to INR.

- DTAA benefits help avoid double taxation if you have income in both countries.

Risks and Limitations

- Currency risk: If the INR stabilizes or appreciates, the currency gain from UAE FDs diminishes.

- Regulatory changes: Tax laws and DTAA provisions can change, affecting NRI strategies.

- Bank/NBFC risk: Always check the latest FD rates and terms with respective banks or NBFCs before investing.

Real-World Scenarios

Scenario 1: Indian Resident in 30% Tax Bracket

- Invests ₹10 lakh in Indian FD at 7%

- Annual interest = ₹70,000

- Tax (30%) = ₹21,000

- Net return = ₹49,000 (4.9%)

- Inflation = 5%

- Real return = 0%

Scenario 2: NRI in UAE

- Invests AED 100,000 in UAE FD at 4.5%

- Annual interest = AED 4,500 (tax-free)

- INR depreciates 4% vs AED

- Effective INR return = 8.5%

- Real return = 3.5% (after 5% Indian inflation)

Frequently Asked Questions

Q: Are FDs in the UAE completely tax-free for Indian NRIs?

A: Yes, for individuals, FD interest in the UAE is not taxed. However, always check if your tax residency status or future Indian tax law changes affect this.

Q: Can Indian residents invest in UAE FDs?

A: Only NRIs or UAE residents can open FDs in the UAE. Indian residents must comply with RBI and FEMA regulations.

Q: What about the safety of FDs in both countries?

A: Both India and UAE have robust banking regulations. However, always choose reputed banks and consider deposit insurance limits.

Conclusion

The UAE vs India FD tax rates comparison highlights a stark difference in post-tax, real, and currency-adjusted returns. For high-income Indian residents, FDs in India often fail to beat inflation after tax, while UAE FDs offer superior, tax-free, and currency-hedged returns for NRIs.

Final Note:

FD rates and tax laws are subject to change. Always check with respective banks or NBFCs for the latest FD rates and consult a qualified tax advisor for personalized guidance.

Disclaimer: The above analysis is based on prevailing rates and regulations as of July 2025. Actual returns may vary. This article does not constitute investment advice; always verify current rates and rules before investing.