India’s 4594 Cr Mega Investment Plan: Building the Future of Semiconductors

Introduction: Every Click Needs a Chip

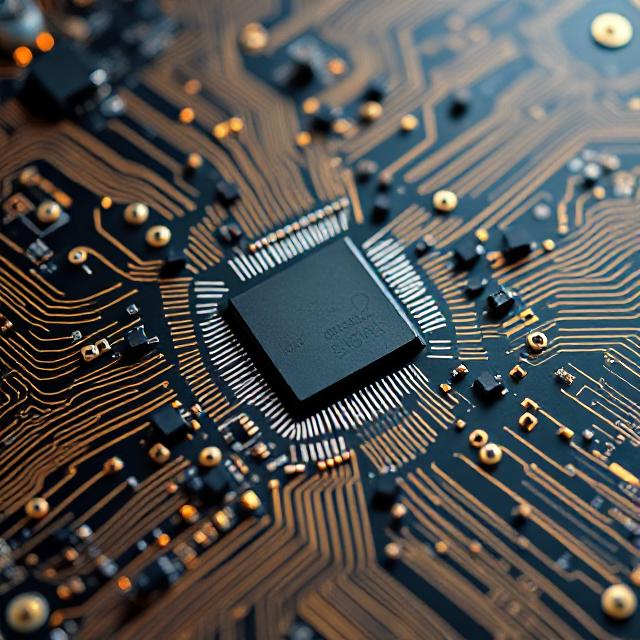

Every swipe on your phone, every UPI transaction, every car ride booked online, and even your morning coffee machine has one invisible enabler—semiconductors.

Often called the “brains of modern electronics”, semiconductors power everything from smartphones and EVs to satellites and defense equipment. For decades, India lagged behind in this critical sector, depending heavily on imports.

But now, with the Union Cabinet approving ₹4594 crore for four new semiconductor projects across Odisha, Andhra Pradesh, and Punjab, India has made a historic shift—similar to its push for defense and railways modernization a decade ago.

This is not just an investment; it’s a strategic bet on India’s technological sovereignty.

💡 What is a Semiconductor? (The Smart Gatekeeper)

A semiconductor is a special kind of material (like silicon) that is neither a full conductor (like copper) nor a full insulator (like rubber).

Think of it as a smart gatekeeper for electricity—just like a water tap regulates water flow, semiconductors regulate electric current.

They are the essential building blocks of:

- Microprocessors

- Memory chips

- Mobile phones

- EV batteries & charging systems

- Telecommunication networks

- Defense radar & aerospace systems

Without semiconductors, the digital economy would collapse.

🌐 The Global Semiconductor Industry: Why India Must Play Catch-Up

The global semiconductor industry is highly concentrated, with only a few countries dominating production.

- Taiwan (TSMC) → ~60% of global chip manufacturing

- South Korea (Samsung, SK Hynix) → Strong in memory chips

- United States (Intel, Qualcomm, Nvidia) → Leaders in chip design

- China → Heavy investments, but still dependent on foreign technology

This supply concentration makes semiconductors a geopolitical weapon. The chip shortage during COVID-19 showed how vulnerable the world was.

India’s entry into this market is not just about economics—it’s about national security, digital independence, and economic leadership.

📊 India’s Semiconductor Market Potential

- Current size (2024): $30 billion+

- Projected size by 2030: $100 billion+

- Indirect impact on electronics, automotive, telecom, defense: Nearly $1 trillion

This is why the government launched the India Semiconductor Mission (ISM) with an ambitious ₹1.6 lakh crore commitment.

🏗️ India’s 4594 Cr Mega Investment Plan – The Four New Projects

The latest Union Cabinet approval (2025) of ₹4594 crore is a landmark moment. The investment is spread across four semiconductor projects in key states:

- Odisha – Focus on chip packaging and testing units

- Andhra Pradesh – New wafer fabrication facilities

- Punjab – Strong in semiconductor assembly

- (Fourth project) – Likely a R&D hub for chip design

This investment is just the first wave of India’s mega semiconductor strategy.

🔑 Why This Investment Matters for India

- Reduces import dependence (India imports >90% of chips today)

- Boosts Make in India for electronics & EV sectors

- Attracts global giants like Intel, TSMC, and Micron to set up here

- Creates lakhs of jobs in manufacturing & R&D

- Positions India as a chip design + manufacturing hub

Just like India’s growth in defense manufacturing and railway modernization, semiconductors could be the next sunrise sector.

📌 Government’s Larger Plan – ₹1.6 Lakh Crores Commitment

The ₹4594 Cr plan is only one part of the broader India Semiconductor Mission (ISM), which includes:

- ₹76,000 crore initial PLI scheme (2021)

- Expansion to ₹1.6 lakh crore (2024-25 onwards)

- Incentives for chip design startups

- Support for OSAT (Outsourced Semiconductor Assembly and Test) units

- Partnerships with global semiconductor leaders

📈 Stocks & Companies to Watch in India’s Semiconductor Play

For investors, the semiconductor push opens massive wealth creation opportunities. Some key Indian companies to watch:

- CG Power – Strong in electronics & power systems

- Solex Energy – Solar + electronics manufacturing

- MIC Electronics – LED & display technologies

- RIR Power – Power electronics for semiconductors

- MCs Chip – Emerging chip design company

- Tata Power – Expanding into semiconductor-linked energy systems

- Dixon Technologies – India’s largest EMS (electronics manufacturing services) player

- Kaynes Technologies – Specialized in semiconductor packaging

- ASM Technologies – Chip design & engineering services

- Surana Telecom – Fiber optics + semiconductor materials

These companies could benefit directly or indirectly from government support and global partnerships.

⚔️ Challenges India Must Overcome

While the ₹4594 Cr mega plan is promising, India must overcome:

- High capital intensity (chip fabs need $5-10 billion each)

- Global supply chain dominance by Taiwan & Korea

- Lack of skilled semiconductor workforce

- Technology transfer restrictions (US/EU won’t easily share advanced nodes)

- Long gestation period (chip fabs take 5–7 years to build)

However, with government push + private sector investments, India can build design, packaging, and assembly strength first, before moving to advanced fabrication.

🌍 The Bigger Picture: Semiconductors = New Oil

Just like oil powered the 20th century, semiconductors will power the 21st century economy.

- Every AI model, every EV, every smartphone → needs chips

- Countries without semiconductor self-reliance risk strategic dependence

- India is ensuring it won’t be left behind

🧩 Questionnaire (FAQs)

❓ What is India’s ₹4594 Cr Mega Investment Plan?

It is a Union Cabinet-approved investment for four new semiconductor projects under the India Semicon Mission, spread across Odisha, Andhra Pradesh, and Punjab.

❓ Why are semiconductors important for India?

Because they power electronics, telecom, EVs, defense, and AI systems. Without chips, India’s Digital India & Make in India visions can’t succeed.

❓ How big is India’s semiconductor market?

It is projected to reach $100 billion by 2030, with ripple effects across industries worth nearly $1 trillion.

❓ Which companies will benefit from India’s semiconductor push?

Stocks like Dixon Technologies, Tata Power, Kaynes Tech, ASM Tech, CG Power, and MIC Electronics are strong beneficiaries.

❓ Can India compete with Taiwan and South Korea?

Not immediately in advanced fabs, but India can become a global hub for chip design, packaging, and assembly within this decade.

❓ What challenges does India face?

High costs, limited skilled talent, and technology transfer hurdles. But with PLI incentives and global tie-ups, India can scale quickly.

🏁 Conclusion: A Silent Hero, Now an Indian Mission

Every swipe on your smartphone, every UPI transaction, every EV ride, and every defense missile has one thing in common—semiconductors.

For too long, India depended on imports. With the ₹4594 Cr Mega Investment Plan and the India Semicon Mission, the country is now laying the foundation to become a semiconductor powerhouse.

Just as India rose in defense, space, and railways, semiconductors could be the next growth engine—fuelling jobs, exports, and technological independence.

The silent hero of modern life will soon carry a “Made in India” stamp.